请 更新浏览器.

发现

- 去找1Four-fifths of our sample received one or more refunds and made no payments. Refund recipients tend to have lower average incomes and smaller cash buffers than those making tax payments.

- 去找2Tax refunds amount to almost six weeks’ take-home income for the average family receiving them. For families making a tax payment, the average payment is equivalent to 2.5周的收入.

- 去找3Among tax refund recipients, average expenditures increase sharply as soon as the refund is received. Six months after the refund, families still have an average of 28 percent of their tax refund remaining.

- 去找4支出 on durable goods, 信用卡付款, and 现金提款 increase most sharply upon receipt of a tax refund.

- 去找5Families for whom the refund has a larger cash flow impact increase their spending and saving most sharply when it arrives.

- 去找6平均, families who make a tax payment cover that payment with cash already available when it is due. Once the payment is made, spending and saving patterns quickly return to their previous steady state.

下载

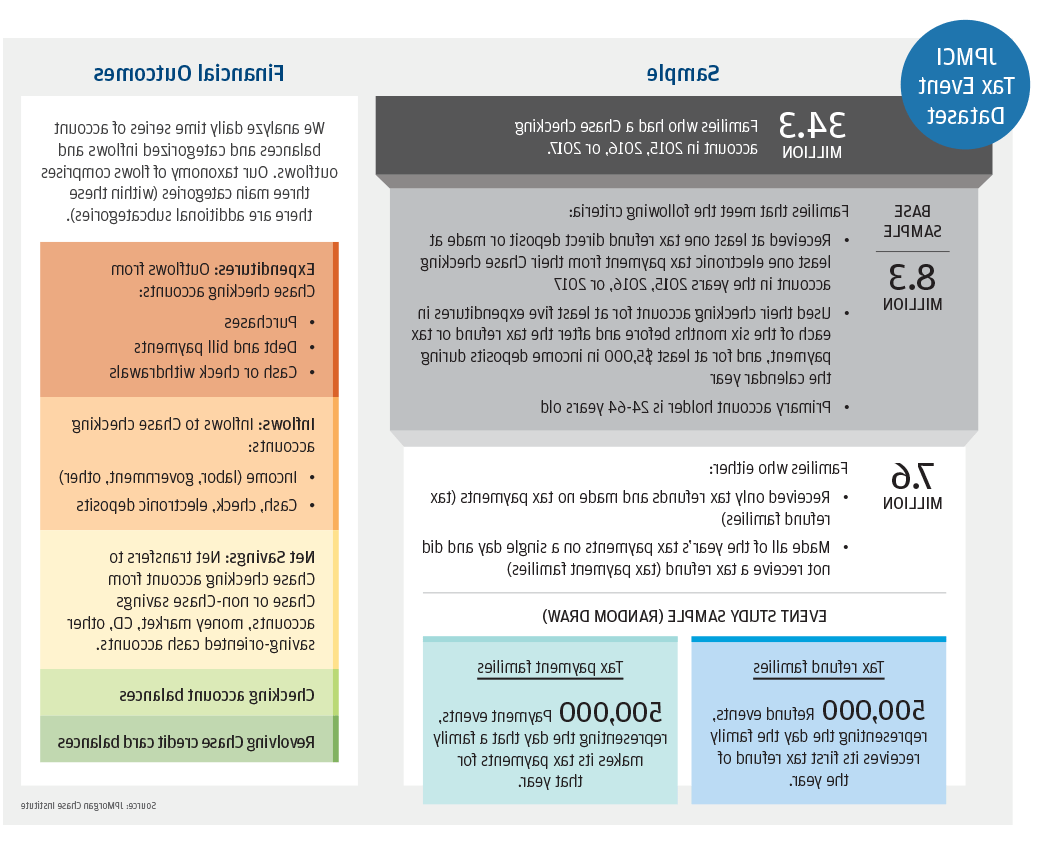

每年春天 more than a half trillion dollars flow into and out of the financial accounts of American families as they reconcile taxes paid against taxes owed for the prior year. Most of these flows–representing 2.5 percent of the year’s total GDP–hit families’ financial accounts during the dozen weeks of the traditional tax season from mid-February to mid-May. In previous 澳博官方网站app 研究所 research, we reported that out-of-pocket spending on healthcare services jumps by 60 percent in the week a tax refund is received and remains elevated for 75 days. This report builds on that research, investigating more comprehensively how families manage the positive cash flow from tax refunds and negative cash flow from tax payments. We analyze daily financial flows and balances for one million families who receive tax refunds or make tax payments, and find that tax reconciliation has a significant and long-lasting impact on spending and saving patterns of some, 但不是所有的.

Our findings underscore that fact that, 不管是有意还是无意, the tax system is a primary tool by which many families generate lump sums of cash. They raise questions about roles that families, financial service providers, and policy makers might play in creating cheaper and more flexible tools for this purpose.

找到一个: Four-fifths of our sample received one or more refunds and made no payments. Refund recipients tend to have lower average incomes and smaller cash buffers than those making tax payments.

The vast majority of families in our base sample are "tax refund" families; they received one or more tax refunds and made no tax payments in a year. "Tax payment families" represent a small minority. In this study we focus on a subset of families making payments—those who make all of their payments in a single day. Tax payment families had higher take-home incomes and larger cash buffers than tax refund families.

发现二: Tax refunds amount to almost six weeks’ take-home income for the average family receiving them. For families making a tax payment, the average payment is equivalent to 2.5周的收入.

Tax refund families receive an average of 5.7 weeks' income in their tax refund, whereas 纳税家庭 pay out an average of 2.5周的收入. This is not only because the magnitude of the average tax refund is larger than the magnitude of the average tax payment, but also because families who make a tax payment tend to have higher take-home incomes. Within each group, a majority of families experience much smaller than average impacts.

发现三: Among tax refund recipients, average expenditures increase sharply as soon as the refund is received. Six months after the refund, families still have an average of 28 percent of their tax refund remaining.

发现四: 支出 on durable goods, 信用卡付款, and 现金提款 increase most sharply upon receipt of a tax refund.

平均 payments on non-追逐 credit cards in the week after the refund is received are 86 percent higher than the average during a typical week prior to the refund. 平均 expenditures on durable goods double in the week after refund receipt, to $50 compared to $25 during a typical week. Families also use their tax refunds to deleverage; average revolving credit card balances are almost 8 percent lower in the month after the tax refund relative to the month before.

发现五: Families for whom the refund has a larger cash flow impact increase their spending and saving most sharply when it arrives.

For almost half of families receiving tax refunds, the refund exceeds the sum of pre-refund balances in all of their cash accounts. 在这些家庭中, 现金提款, non-追逐 credit card bill payments, and durable goods purchases more than triple in the week after the first tax refund is received. Among the rest of families, these flows increase more modestly—by less than 50 percent. We also find that those who file earliest in the season increase their spending and saving most sharply when the refund arrives.

发现六: 平均, families who make a tax payment cover that payment with cash already available when it is due. Once the payment is made, spending and saving patterns quickly return to their previous steady state.

Payment families in our sample do not cut expenditures or increase their labor income to cover the payment. 而不是, they transfer cash into their checking accounts during the three weeks leading up to the payment. Unlike with refund families, payment families' expenditures and account balances settle quickly back to the original steady-state after the payment is made.

每年春天, more than half a trillion dollars flow into and out families’ financial accounts as they reconcile taxes paid against taxes owed for the prior year. 在这份报告中, we analyze daily financial flows and balances for one million families who receive tax refunds or make tax payments, and find that these flows have a significant impact on the financial lives of some 但不是所有的.